The RBI additionally guarantees the stream of credit to other need divisions too.The functions of the RBI can be categorised as follows:

Review and Inspection: The strategy of review and assessment is controlled by the RBI through off-site and on location observing framework.They do this through danger administration in basel standards. Hazard Management: The RBI gives rules to banks to making the strides that are important to relieve hazard.Straightforwardness Norms: This implies that each bank needs to unveil their charges for giving administrations and clients have the privilege to know these charges.Each bank needs to guarantee KYC standards are connected before permitting somebody to open a record. KYC Norms: To control tax evasion and keep the utilization of the saving money framework for monetary criminal acts, The RBI has “Know Your Customer” rules.The RBI has forces to designate extra chiefs in banks too. Corporate Governance: The RBI has energy to control the arrangement of the administrator and chiefs of banks in India.As being what is indicated, they are in charge of usage of global guidelines of capital sufficiency standards and resource arrangement. The RBI is an individual from the Banking Committee on Banking Supervision (BCBS). Prudential Norms: The RBI issues rules for credit control and administration.Under the authorizing arrangement, the RBI gives managing an account benefits in regions that don’t have this office. The RBI likewise concedes licenses to open new branches for existing banks. Issue Of License: Under the Banking Regulation Act 1949, the RBI has been offered forces to give licenses to initiate new keeping money operations.The control and supervisory parts of the Reserve Bank of India is done through the accompanying: The RBI is in charge of controlling the general operations of all banks in India.

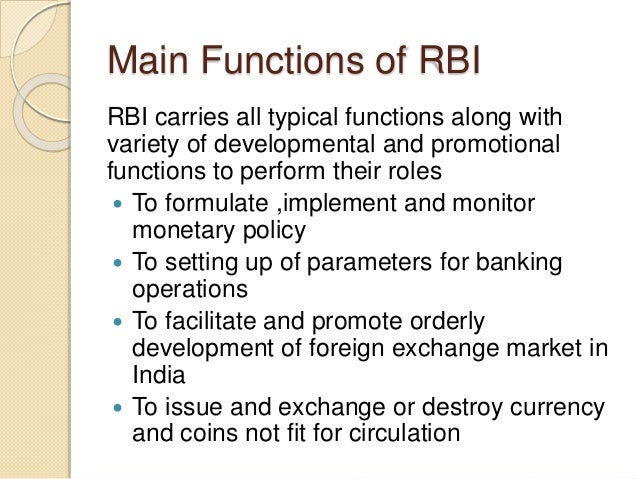

The RBI has been doled out the part of controlling and regulating the bank framework in India. The RBI additionally makes a move to control flow of fake money. The RBI Act offers power to the RBI to issue money notes. Diverse Rates, for example, repo rate, reverse repo rate, and bank rate.Money Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR),.The apparatuses utilized for execution of the destinations of financial strategy are: The fundamental goals of observing money related arrangement are: The RBI plans fiscal arrangement twice per year. Giving diverse devices to clients’ assistance, for example, going about as the “Managing an account Ombudsman.”.Keeping up individuals’ trust in the managing an account and money related framework, and.Checking distinctive key markers like GDP and expansion,.Controlling cash supply in the framework,.The RBI controls the Indian saving money and monetary framework by issuing wide rules and directions. The RBI has diverse capacities in distinctive parts. The Banking Regulation Act 1949 and the RBI Act 1953 has given the RBI the ability to manage the saving money framework. The RBI assumes part of controller of the managing an account framework in India. In India, the Reserve Bank of India (RBI) is the Central Bank. The capacity of the national bank of a nation is to control and screen the managing an account and monetary arrangement of the nation. In every nation there is one association which fills in as the national bank.

0 kommentar(er)

0 kommentar(er)